Dear shareholders,

It has been an interesting, often financially rewarding year here at the Occidental Moron Corporation. Thingy production, from which Occidental Moron (or, as we like to call it, the Oxy) has traditionally obtained 97 per cent of its revenue, held steady, and increased slightly in the fourth quarter. However, various business transactions over the course of the year have left many shareholders unsure of who owns Occidental Moron, and what it is that we do. Thus, I have been asked to report on the events of 1985, and how they affect you, the shareholder.

As you may recall, negotiations for the sale of Occidental Moron to Consolidated Production had been embarked upon in late 1984. Consolidated Production makes whatsits, of which thingys are an integral part. It was hope that a merger of the two companies would streamline whatsit production, eliminate duplicate management and otherwise generally benefit all concerned (including consumers, who might pay less for their whatsits). Rumours of the merger started pushing Occidental Moron stock up as soon as the markets opened in January.

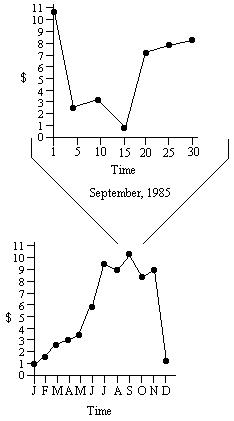

Thus, if you had started with $1.00 worth of Occidental Moron stock on January 1, it would have been $3.07 on March 12, when the finalization of the merger was announced. Shares in Occidental Moron were traded for shares in the new company, Occidental Moron and Production, at market value.

Shake-ups in the upper echelons of Occidental Moron and Production gave markets the message that the company was serious about pursuing increased profits, and the value of the stock rose accordingly. By May 1, it was worth $3.50. Then, T. “Slim” Pickens began offering $7.00 per share, twice the market value. Why Pickens, a corporate raider best known for his acquisitions of oil companies and suppository manufacturers, was interested in a whatsit company may never be known.

Pickens incorporated under the name Occidental Moron and Production Acquisition Corporation. To raise the money necessary to buy a controlling interest in Occidental Moron and Production, he put up bonds, promising to sell off portions of the corporation once he had acquired it to back the bonds. At that time, Occidental Moron and Production management started buying up shares as well, at the inflated price. We had about 23 (shares, not per cent) when Pickens suddenly pulled out owing to over-extension of credit. (I understand that he now works in his brother’s vineyard.)

To our surprise, the market value of Occidental Moron and Production stock continued to rise instead of returning to its earlier level. It is possible that staving off Pickens’ advances gave investors increased confidence in the company, although I believe that people probably just forgot how our stock had hit $7.00 in the first place. No matter; I have learned to trust the wisdom of the marketplace.

In July, Occidental Moron and Production had to sell off some of its thingy makers (known in the trade as thingers) and sheet metal stores in order to repay debts accumulated in the aborted take-over. This temporarily drove prices down from a high of $10.02 to $9.50. By late August, Occidental Moron and Production reached an all-time market high of $10.95. Then, in September, things fell apart.

Occidental Moron and Production started the month by merging with Sales ‘N’ Stuff. Management believed that the combined production/delivery/sales capacity of the two firms would profit all concerned. Almost at once, rumours that Occidental Moron and Production would be investigated for illegal combines activity sent the stock plummeting. By September 5, it was worth $2.11. Traders, realizing that the stock was undervalued, started buying up shares, causing the prices to slowly creep back up. But, when management announced that it was selling Sales ‘N’ Stuff, the stock hit a low for the year of $0.79.

In desperation, management decided to buy Continental Doohickey, a take-over that, coming as a complete surprise, was accomplished in less than three hours. Doohickeys have little to do with thingys or whatsits, of course, and all of Continental Doohickey’s assets were quickly liquidated, netting Occidental Moron and Production $5,789,238.74, and sending our stock back up over $8.00. (For a breakdown of the year’s stock movements, with September highlighted, see Graph 1.) Then, after a month’s grace period, MultiNatCorp stepped in.

GRAPH 1

Occidental Moron stock prices, 1985

The huge multinational has its own whatsit and thingy production facilities, and management was very much afraid that MultiNatCorp’s real intention in buying Occidental Moron and production stock was to close the company, ridding MultiNatCorp of a competitor. Thus, management entered into a bidding war with MultiNatCorp, although we held little hope of succeeding against its vast resources.

In December, MultiNatCorp owned or controlled a majority of shares in Occidental Moron and Production, and started firing employees and liquidating assets. As of this writing, I am the only executive left from the original firm, and my term will end tomorrow, December 31 (with a very generous severance package in the neighbourhood of $12,000,000).

So, to sum up: Occidental Moron stock worth $1.00 on January 1, was Occidental Moron and Production stock worth $1.01 on December 30. Should you have any further questions, please direct them to the officers of MultiNatCorp.

Sincerely,

Harold Fenderbender

Former President, the Oxy